6 Financial Goals and the secrets you need to achieve them!

The beginning of a new year is a great time to take stock and think about how you can improve your life. Many of us start the year with good intentions, but things often get in the way as the year progresses.

The beginning of a new year is a great time to take stock and think about how you can improve your life. Many of us start the year with good intentions, but things often get in the way as the year progresses.

Getting your finances in order is a common resolution and like quitting smoking and losing weight, there is no quick and easy solution. The best way to make 2016 a year of real achievement is to make a few small, regular changes and reap the benefits over time.

Below are 6 common goals we hear from our clients, and some tips on how to help you achieve them.

Spend Less

Everyone has monthly expenses—you need a place to live and to eat. But you may be able to reduce the costs—from refinancing to a lower mortgage rate to shopping around for lower-priced phone or electricity plan, and stocking up on things you use often when they are on sale. Discretionary expenses—those “nice to haves”—likely provide an even bigger opportunity for savings. If spending less is your goal, take a look at how often you eat out and any impulse purchases. When you see how much they cost you each month, it may provide the incentive to cut them out.

Save More

Saving more is a close cousin to spending less. After getting a sense of your spending, you can begin to figure out how to increase your saving. A haphazard approach to saving will almost certainly produce haphazard results. The key is to create a savings plan that will help you stay disciplined when it comes to the amount you put away each month to meet your various savings goals. One of the simplest ways to ensure you save regularly is to make it automatic. That means scheduled, regular, automatic transfers into a savings or offset account. If the money isn’t in your spending account, for instance, you are less likely to spend it frivolously.

Pay Down Debt

Credit-card debts, car loans, and mortgages— you probably have a variety of debt, as most people do. And the monthly payments can take a big bite out of your income. The key is to pay down the debt with the highest interest rate first, which is usually high interest rate credit cards. Consider paying more than the minimum each month. Check your credit card statement to see how long it will take you to pay off the balance—and how much it will cost. The statement usually suggests how much you need to pay each month to pay it off completely.

Set Aside Money for an Emergency

Managing your money would be much easier if life went exactly as planned, but it seldom does. That’s why an emergency fund is essential for dealing with everything from a blown transmission to a lost job. It’s recommended to have a cash reserve sufficient to cover three to six months of expenses. Ideally in an offset account if one’s setup.

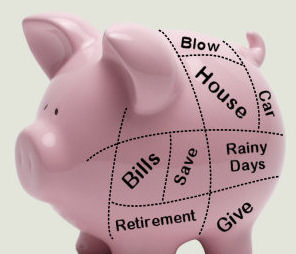

Have a Budget… and Stick to it!

Trying to navigate your financial life without a budget is like trying to drive a car without a speedo. You’d never do that, really? The good news is that you don’t have to micromanage every penny. After a quick analysis of your current spending into some basic categories, compared with your expectations is a great start to trimming the financial fat. Undoubtedly, your financial situation will change over time. A budget is essential for both spending and saving. Once you know where your money is going, you can make an informed decision about how to allocate it.

At Burgundy House, we take your finances seriously, we’re more than just your average street corner mortgage broker – we’re in it for the long haul with you. So if you need any help along the way, whether you’re starting out, trying to save for your deposit, or paying down your debts, or looking to retire – give Matthew a call to discuss ways we can help you.